Green Tie Capital’s portfolio and investment is backed by an extensive analysis process, in which the performance of the asset is rigorously evaluated, using its own business models which have been contrasted with the main financial institutions.

The Green Tie Capital team is in a continuous process of analyzing potential investments. These opportunities cover the entire spectrum of possibilities, from the development of new green field projects to the acquisition of assets/companies already in operation

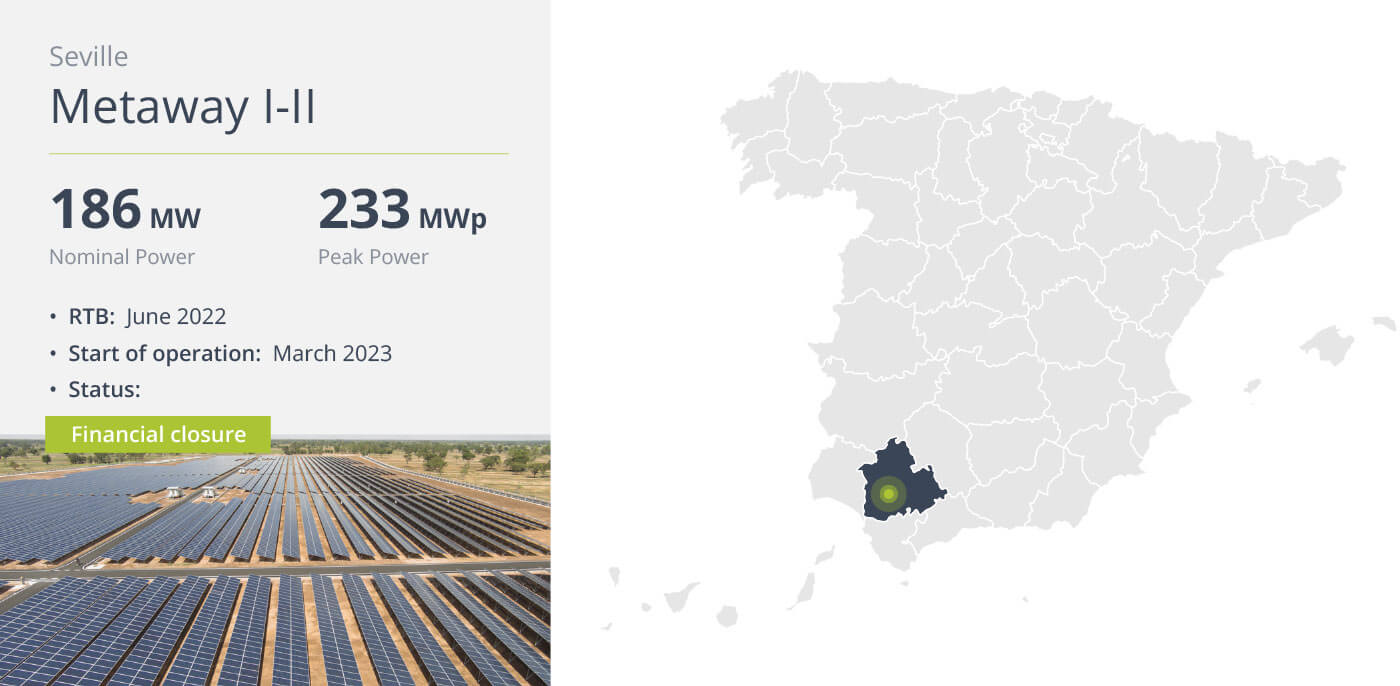

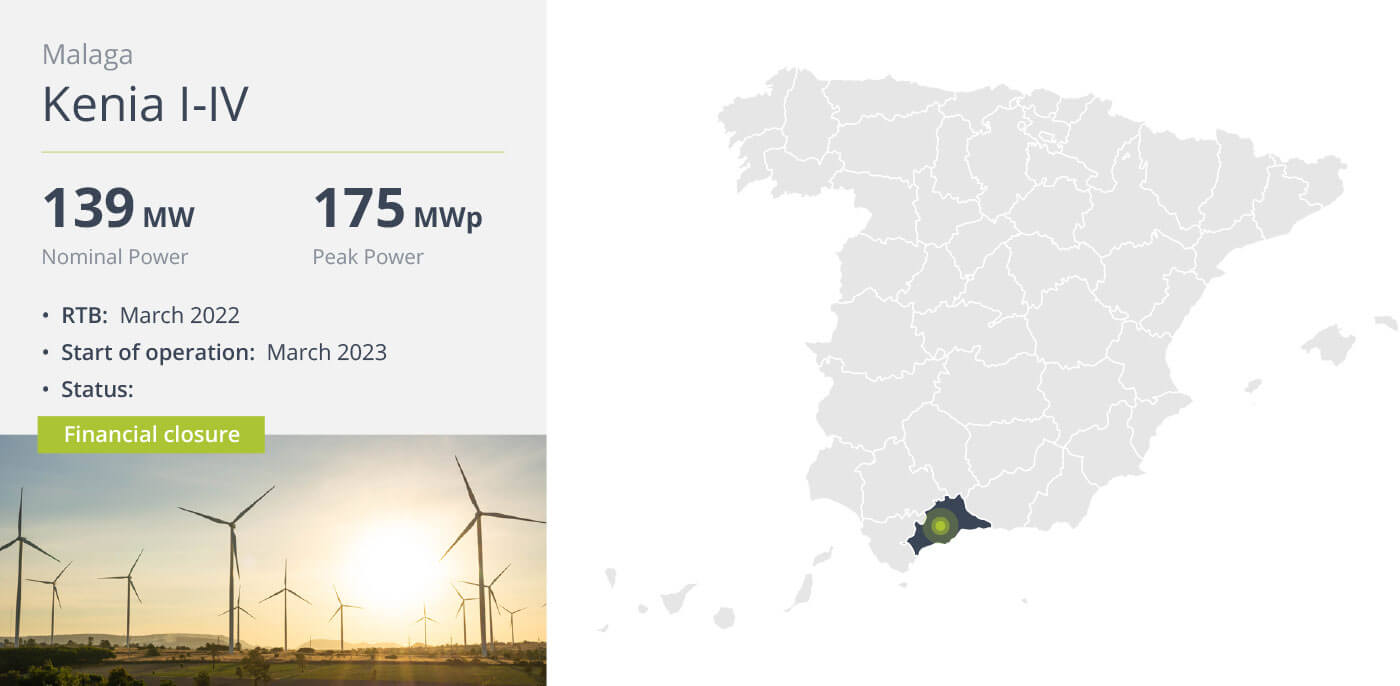

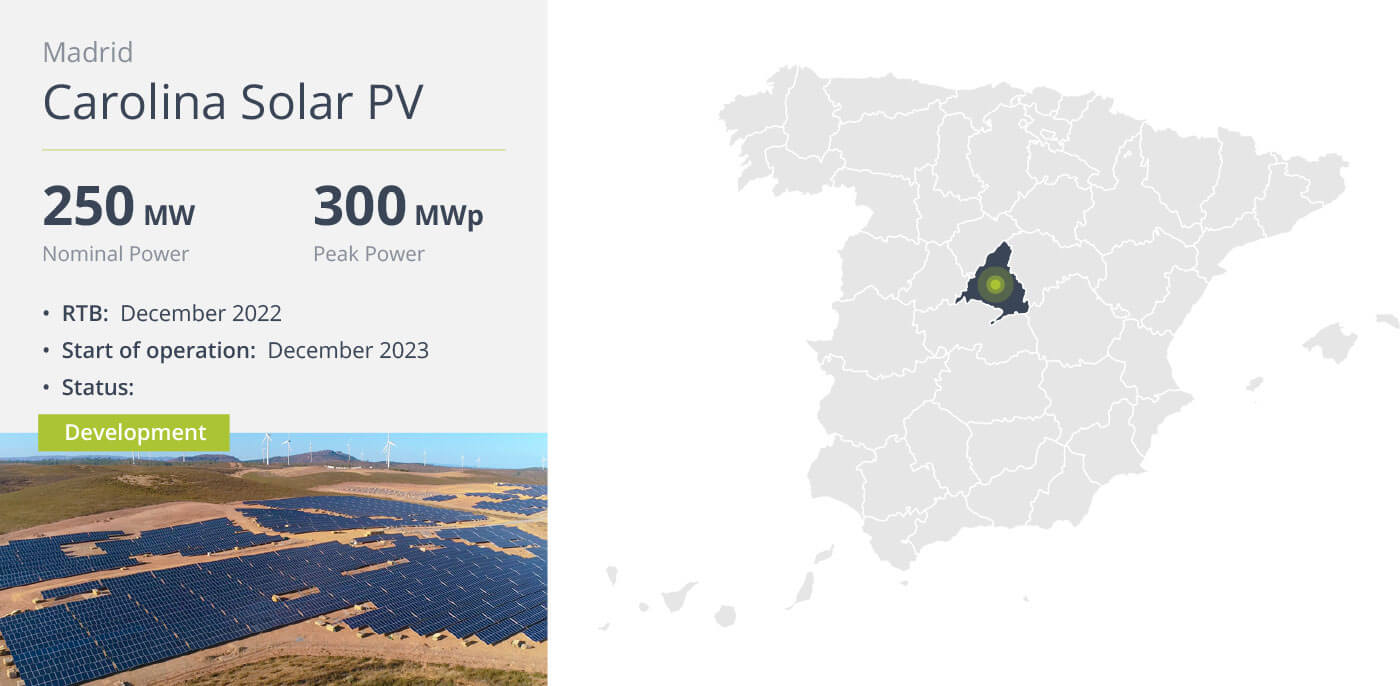

We are continuously analyzing possibilities to expand our portfolio of renewable energy projects (solar and wind), seeking cooperation with suppliers and investors. Our strategy includes the acquisition of land for green field developments and the acquisition of projects under development or commercial operation (with a capacity of more than 25 MW).

We seek out risk investment opportunities in companies with the sustainable seal, through funds established to make effective use of the best opportunities on the market.

Our investments are focused on small businesses with high growth potential.

Our team works intensively in monitoring the development of the electric mobility industry, focusing mainly on investments for the implementation of electric vehicle charging stations with renewable energy and information systems.

We invest in a real estate selection that has been developed to be aimed at the sustainability of the environment in its construction and operation

With the ambition to continue growing in sustainability, we are committed to the development of new technologies linked to the generation of renewable energy, including fuel cells and electric batteries with our R+D+i investment analysis team.